Professional Indemnity Insurance

Essentials for all Professionals

Professional Indemnity Insurance is essential protection for professionals who provide a service, including design and advice.

Professionals are only human and mistakes do happen. Any financial loss, injury or damage arising from a mistake, or failure by the professional to exercise the required level of skill, may mean that an award is made in favour of a person or company who suffers a loss, damage or injury.

A professional may also be held liable for a mistake even though there was no negligence. Defence costs under the policy are made available to dispose of such allegations.

Who is a Professional

A professional will hold himself or herself out as having a special skill, which can be relied upon by another. Consequently the law requires that the professional exercise the required skill to an appropriate level expected by that profession.

Anyone who provides an individual or company advice and/or services of a skilful character (according to an established discipline) might be regarded as a ‘Professional’. That means persons other than those in ‘traditional’ Professions, such as doctors, lawyers, architects and engineers, are now considered to be ‘Professionals’ e.g. IT consultants, advertising agents, real estate agents, mortgage and finance brokers, management consultants, trade associations and fund managers.

Who can make a claim against you

Any third party such as a customer, supplier, competitor, regulatory authority (including ACCC, ASIC, EPA), Industry bodies and others can make a claim against you, if they have allegedly suffered a loss due to negligence (or alleged negligence) arising from your professional services.

Claims can arise from various allegations including:

- Breach of your duty of care

- Negligence / Common Law Matters

- Civil Liabilities

- Conflicts of Interest

- Breach of Confidentiality

- Competition and Consumer Act or similar commonwealth legislation designed to protect consumers

What does Professional Indemnity Insurance Cover?

Professional Indemnity Cover provides indemnity for claims brought against you for financial loss, injury or damage arising from a breach (or an alleged breach) of your professional duty in the course of conducting your business. Professional Indemnity Insurance aims to protect your assets in the event of a claim to ensure you can still carry on your business.

The need for Professional Indemnity Insurance is not to be confused with Liability Insurance. Liability Insurance expressly excludes claims arising from advice or design, where a separate fee is charged.

As a business owner, it is important that you have a sound understanding of both insurance and uninsured exposures for your business due to the inability to control all outcomes.

What is a “Claims Made” Policy

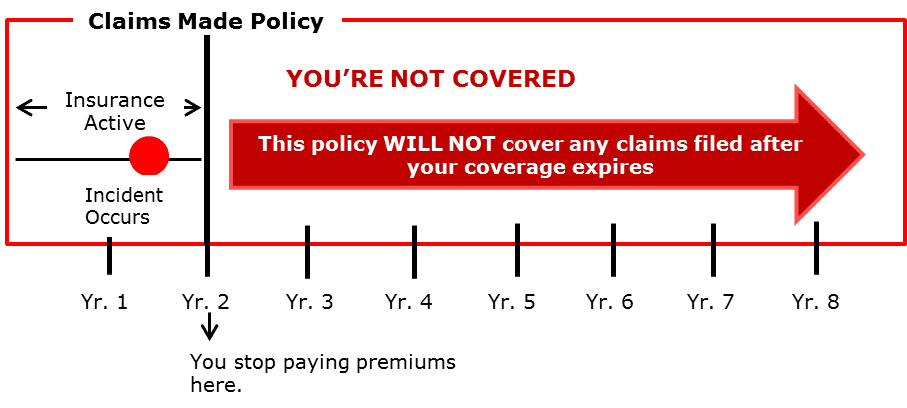

Professional Indemnity Insurance is offered on a “claims made” basis, meaning it only covers claims made or possible claims that you become aware of (or could reasonably be expected to give rise to a claim) that are notified to the insurer within a current or active policy period. This is distinct from an “occurrence” based policy that covers any claim, provided the loss “occurred” during the policy period, no matter when the claim is brought against you.

Under claims made policies, an act or omission may have occurred in a prior period, and as long as that act or omission was on or after the retroactive date, the policy will extend to those prior acts (assuming the claim was not intentionally withheld at the last renewal and reported within a reasonable timeframe) and you have maintained continuity of cover with the same insurer.

It is essential to maintain continuity of PI insurance cover, as claims made against you, or circumstances which you become aware of that could give rise to a claim, will not be covered if they are not disclosed within the period of insurance they first arise.

If there is any claim or potential claim, or even a circumstance that could reasonably be expected to give rise to a claim, it must be reported to your insurer immediately, regardless of your own view as to fault. If you know of a claim or circumstance and it is not reported within the insurance period in which it arises, your insurance policy is unlikely to respond.

The below diagram illustrates the importance of notifying claims under a claims made policy whilst the policy is current. Failure to do so means you will not be covered.

What is a ‘circumstance’ that could give rise to a claim

This varies from insurer to insurer, so always check your policy first. Generally, the definition of “claim” will define what a notifiable event is.

If you become aware of a mistake that could give rise to a future claim, you should report it. Consider if the error is likely to cost your client money, or be a breach of your company or professional guidelines.

We should also dispel any beliefs that any incident reported to an insurer will cause premiums to rise. Not true, unless the issue is likely to result in a claim. Instead, what this does is demonstrate an understanding of the policy holder’s obligations to report any issue that might later require the policy’s assistance – something that is viewed very favourably by insurers in most cases.

Questions to consider when setting your Sum Insured

- When considering the level of cover for your Professional Indemnity Insurance, you need to review your past, present and future business and review the exposure to types of possible claims that may arise from your clients and other third parties.

- In general, a sum insured of less than $1 million is unlikely to be adequate for even a small practice which assesses its exposure as low.

- In a worst-case scenario, if something went wrong, what could be the potential financial loss to third parties?

- Is there a potential for bodily injury claims (or even multiple injuries) arising from your professional services?

- What is the potential for financial loss to any third party arising from your professional services?

- What is the potential for multiple claims in any one policy year?

- Does your policy limit include defence costs and erode your policy sum insured, or are defence costs in addition to the policy limit? Consider the potential legal and investigation costs which may be incurred over the life of the claim.

- How long may a claim take to settle? Claims can sometimes take many many years to finalise, which means the legal costs and interest liability will mount, as will the effect of inflation.

- How many parties may be implicated in any claim or action? The more parties there are, the more difficult and costlier it is to settle a claim.

- What is the nature, scale, and complexity of work done in the past and during the policy period? A policy generally covers exposure from prior work, where the retroactive date has been extended to do so. Consider any potential risk exposure that may arise from prior business activities, as in some cases it may take years before a liability becomes apparent.

- What is the overall contract/project value you work on? You may only have a small part and only earn a small amount of fees, but consider whether an allegation of an act of negligence, error or omission could delay the entire contract/project and be extremely costly.

- Review contractual or legislative obligations to take out a minimum level of cover.